Are you evaluating different identity verification providers and heard about Sumsub? That makes sense—it's a well-recognized company with thousands of clients worldwide and a solid reputation backing it up. But is it really the best choice for your business?

The market offers plenty of options. If you're looking for a Sumsub alternative that's faster, more transparent, and doesn't lock you into unnecessary commitments, here's why Didit has become the fastest-growing company in recent months, gaining ground as the preferred choice in LATAM, Europe, and beyond.

Notice: The information in this comparison (Didit vs Sumsub and the best alternatives in fraud prevention and KYC) comes from online research and various user comments across different platforms. This content was updated in the second quarter of 2025. If you believe there's an error or need to request a specific correction, please contact us.

What Does Sumsub Offer?

Sumsub is a powerful platform backed by major institutions with years of experience behind it. Among its features, it offers document verification, biometrics, liveness detection, AML screening, continuous monitoring, and more.

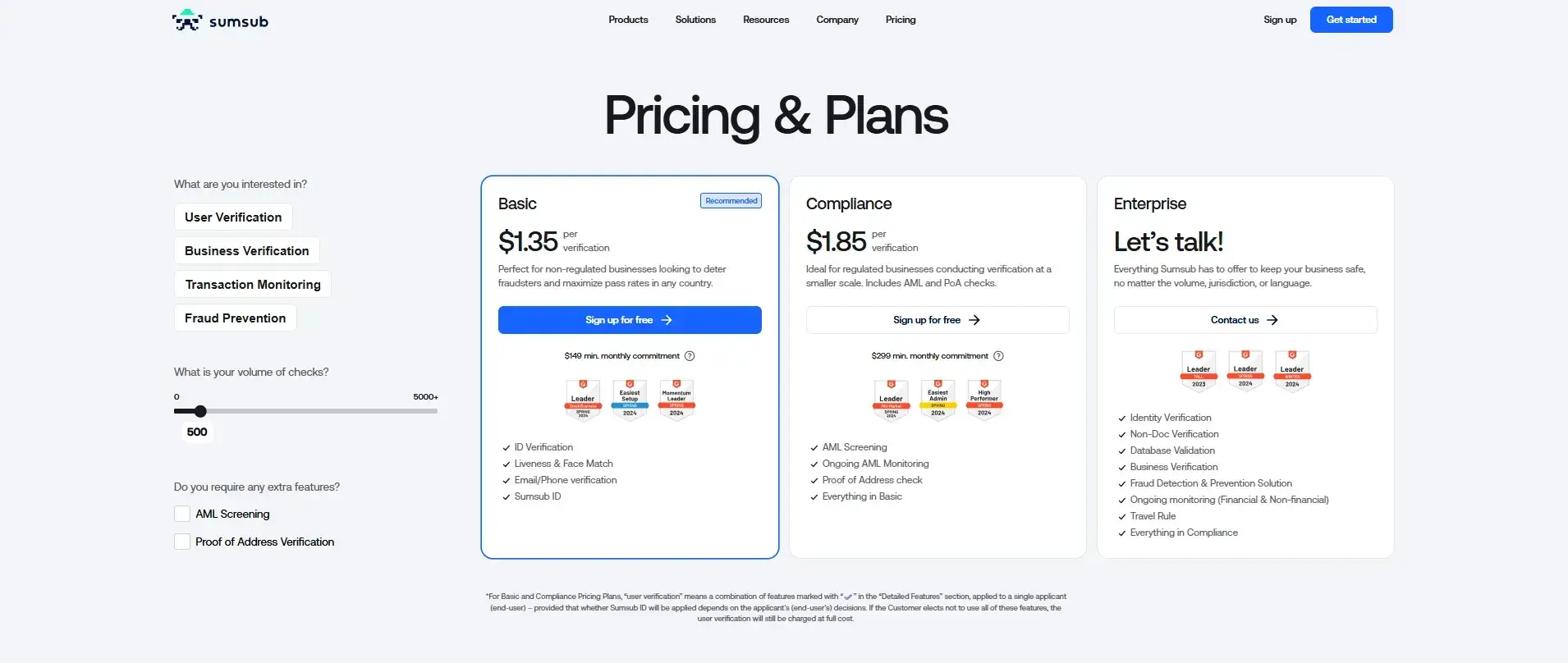

But like many industry giants, it's not the most flexible option:

- Monthly contracts with minimum spending requirements

- Additional charges for features

- Longer integration timelines

- Limited operational autonomy

In short, Sumsub is a solid player in the identity verification market, but it's hardly scalable.

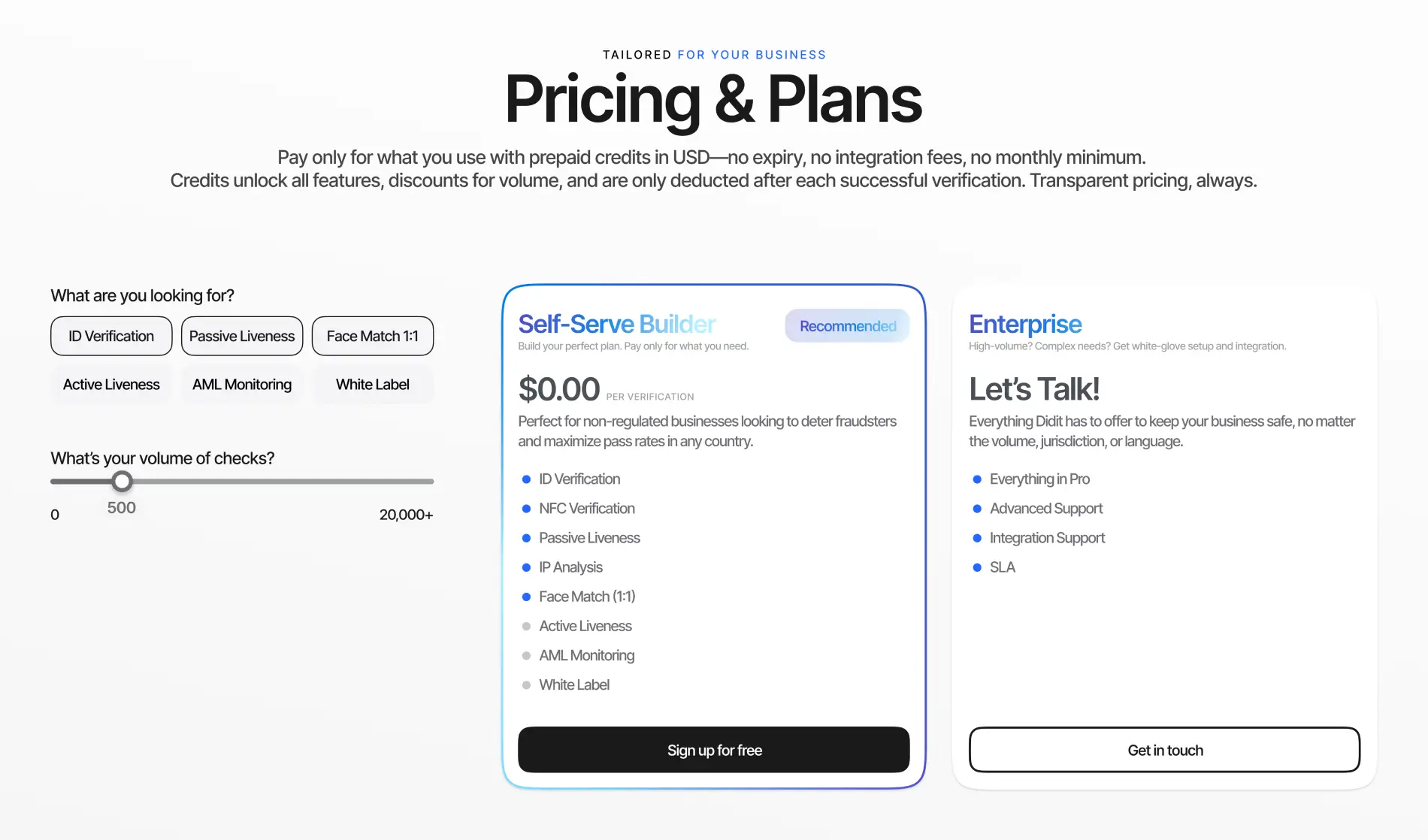

Why Didit is Different: A Modular, Flexible, and Affordable Sumsub Alternative

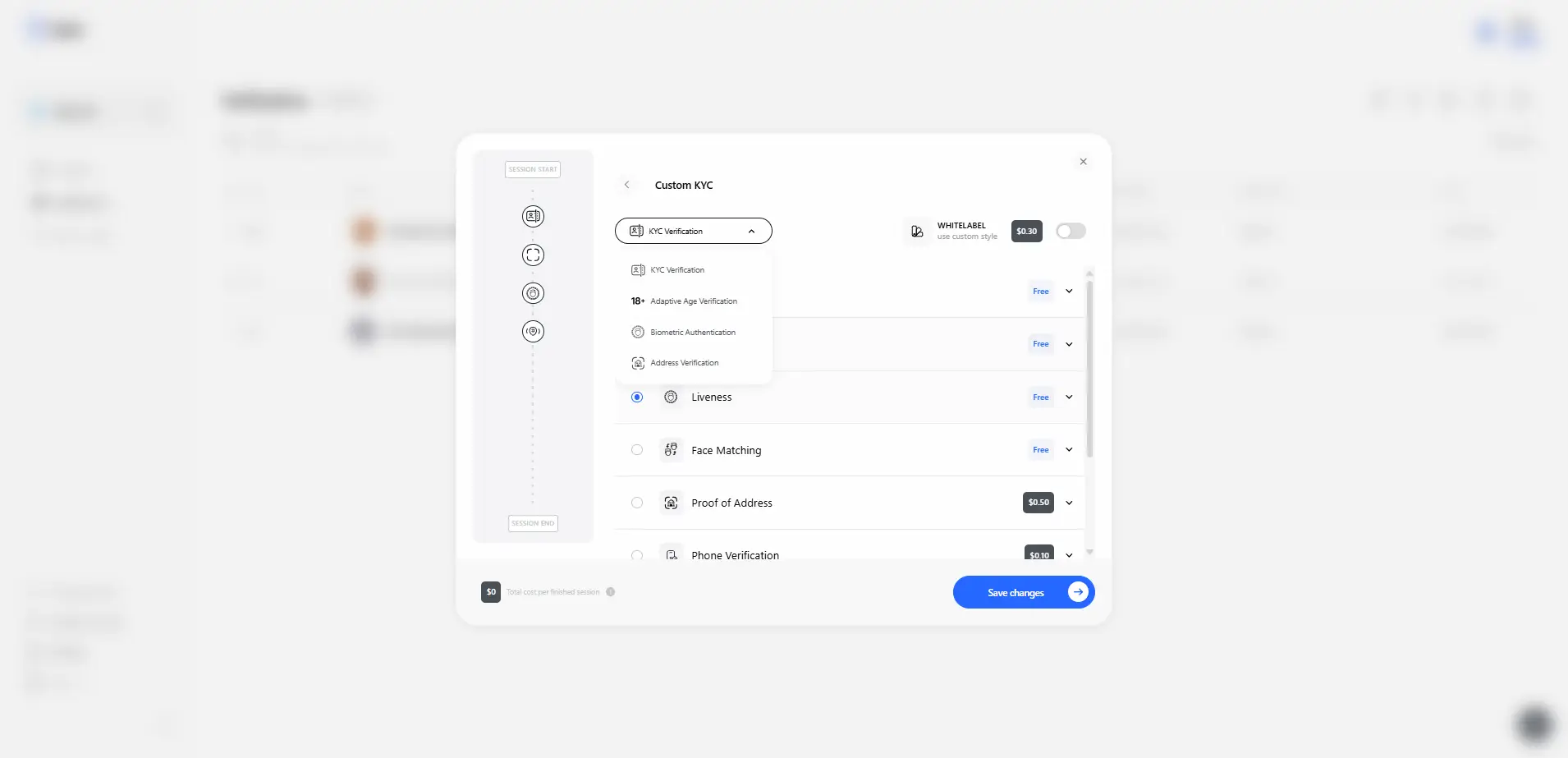

Didit is the most advanced identity verification platform on the market, built for the AI era. As a Sumsub alternative, we offer a simple solution (that can be launched in minutes), flexible (to build your own workflows), open (completely full-service), and affordable (with up to 70% savings compared to other market solutions).

This way, whether you're launching a fintech, scaling a telco, or running a global platform, with Didit you have total control over your user verification, with global coverage and regulatory compliance.

Comparison Table: Where Didit Outperforms Sumsub

Why Look for a Sumsub Alternative in 2025: Didit, the Market's Best Identity Verification Platform

Identity verification has evolved. Today it's not just about regulatory compliance—it's about creating smooth, secure, and scalable experiences for users who expect to get everything done in seconds, not minutes.

While Sumsub follows a traditional model, Didit has committed to reinventing KYC for the post-pandemic, post-password, pro-product era.

Here are some reasons why more and more companies are migrating from Sumsub to Didit:

- Transparent model: Free KYC, public pricing, zero forced commitments.

- Reusable identity: With Didit ID, your users don't have to verify themselves over and over again. One verification, multiple platforms.

- Smart workflows: Build custom flows without a single line of code. Launch tests in minutes, not weeks.

- True global coverage: Over 200 countries, no friction, no surprises.

- Validated growth: In just six months, Didit has surpassed 1,000 active clients. And it keeps accelerating.

Try It Now: Free, Frictionless, No Strings Attached

If you're looking for a Sumsub alternative that lets you move faster, spend less, and have total control of your verification stack, you're in the right place.

👉 Sign up for the Business Console at no cost

👉 Check out our public pricing

Have you calculated how much Sumsub’s processes are really impacting your bottom line? Companies switching from its traditional model to Didit are seeing up to 70% monthly savings on KYC verification costs. You’ve just seen how our technology outperforms legacy platforms — now it’s time to quantify the true cost of inflexibility. Our ROI Calculator will show you in seconds how much closed contracts with Sumsub are draining your budget, and how Didit can turn slow processes into fast, scalable savings month after month. Forget complex implementations and surprise pricing: total transparency, real speed, proven ROI.

Enter your current data and discover how much you could save by breaking free from legacy verification models.