Identity Verification, KYC and AML Compliance in Colombia

Key takeaways

Digital identity verification has become a critical tool to combat online fraud, especially against threats like deepfakes and generative AI that compromise the security of digital transactions.

The KYC process in Colombia requires an advanced technological approach integrating document verification, biometric facial recognition, and AML screening, adapting to the complex local regulatory reality.

Colombian companies face significant challenges in identity verification, with a 43.5% growth in digital fraud attempts and the need to comply with strict data protection regulations.

Digital transformation demands identification solutions that balance security, accessibility, and regulatory compliance, using technologies such as artificial intelligence, biometrics, and multimodal document validation.

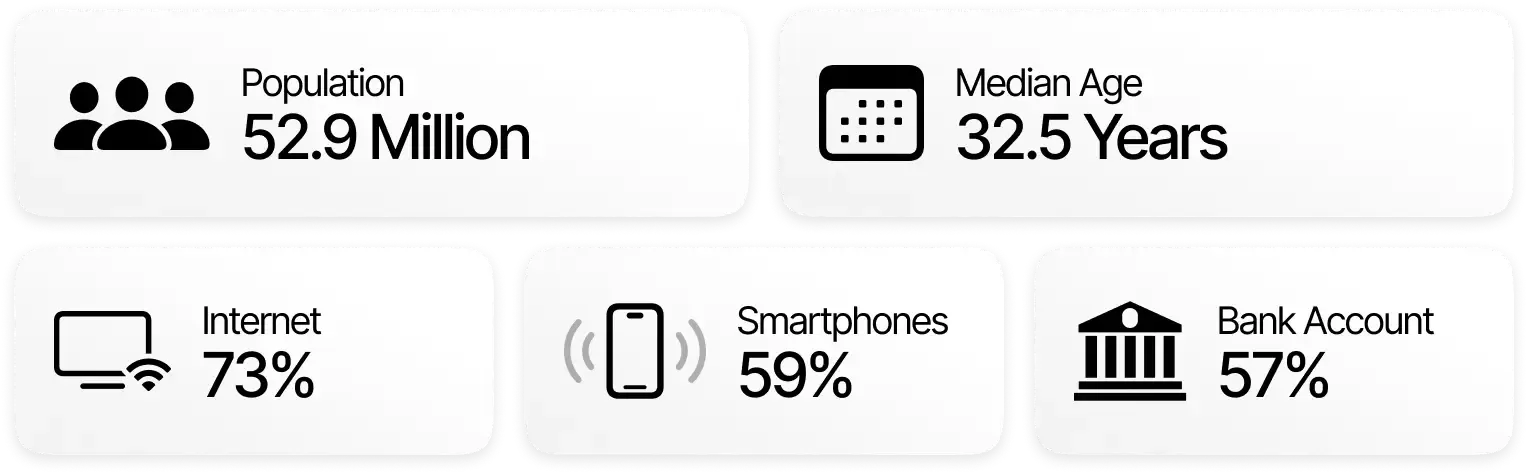

With over 44 million inhabitants and a constantly growing digital economy, Colombia is consolidating as a strategic territory for companies that understand the rules of the financial game. The Financial Information and Analysis Unit (UIAF) makes it clear that there is no room for improvisation: obligated entities must comply with strict KYC and AML regulations in Colombia, especially when it comes to financial and digital transactions. Thoroughly understanding local Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements has become a critical necessity for any organization seeking to operate with transparency and security in the Colombian market.

Failure to comply with these regulations can result in significant sanctions which, according to the Financial Superintendence, can represent millionaire fines and even suspension of operations. KYC in Colombia plays a fundamental role in protection against money laundering, terrorist financing, and other financial risks. In a context where digital transformation is advancing by leaps and bounds, identity verification has become the most important protective shield for local obligated entities, with the focus primarily on financial institutions.

The legal framework of KYC and AML in Colombia: regulatory requirements

The Colombian legal framework for KYC and AML acts as a shield for companies against potential irregular financial activities. Controlling these regulations will help obligated entities in Colombia operate safely within the local financial market.

Law 1121/2006: Foundations for the prevention of terrorist financing

Law 1121/2006 represents a before and after in Colombia's national strategy against money laundering. This regulation establishes a comprehensive framework of control and reporting mechanisms, defining the protocols that obligated entities must follow to identify, prevent, and mitigate risks associated with terrorist financing or other illicit activities.

Some of the key elements of this regulation include the precise definition of due diligence procedures, the obligation to maintain detailed transaction records, and the implementation of early warning systems that allow entities to quickly and effectively detect suspicious operations.

Basic legal circular of the Financial Superintendence: A comprehensive regulation

The Circular of the Financial Superintendence delves deeper into Colombia's regulatory framework, providing specific guidelines for financial institutions in the implementation of SARLAFT systems (Risk Management System for Money Laundering and Terrorist Financing).

This Circular discusses technical concepts, but also defines in depth the compliance standards that Colombian obligated entities must adopt. Among them:

- Methods for evaluating operation risks

- Procedures for identity verification in Colombia

- Protocols for continuous transaction monitoring

- Reporting and documentation systems

UIAF Resolutions: Precision in AML measures in Colombia

The resolutions of the Financial Information and Analysis Unit (UIAF) complement the regulatory ecosystem in Colombia. These guidelines focus on providing more precision in anti-money laundering (AML) measures in the country, establishing precise mechanisms to detect and report potentially criminal actions.

These resolutions promulgated by the UIAF mainly focus on two aspects:

- Definition of reporting obligations for different industries, mainly economic sectors

- Development of due diligence guides that allow local obligated entities to have effective and transparent know your customer (KYC) processes

Identity verification in Colombia: a challenge for companies

Identity verification in Colombia is a challenge for many KYC providers working in the Latin American environment. According to a TransUnion report, digital fraud attempts grew by 43.5% in the first half of 2024 compared to the previous year. This impressive figure demonstrates the obsolescence of current KYC methods in Colombia, which need more technological solutions.

Regulations don't make it excessively easy either, especially when we talk about privacy and data protection, fundamental aspects of the Colombian regulatory environment. The Statutory Law on Personal Data Protection (Law 1581) meticulously delimits the collection and use of personal information, challenging many traditional identity verification systems.

In Colombia, multiple official documents coexist: citizenship card, passport, identity card, or driver's licenses, among others, are part of this documentary puzzle. This diversity can generate friction for many companies and KYC services, as they are unable to work with this official documentation.

Challenges in document verification in Colombia

Document verification in Colombia is complex and poses a challenge for traditional authentication methods. Since July 2010, the country began working on official documentation that is difficult to falsify thanks to its technology. For this, most documents respect the standards of the International Civil Aviation Organization (ICAO).

For example, the Colombian passport has had an electronic chip since August 2015, when the first electronic passports began to be issued. As in other similar documents, this chip contains biometric information of the holder, as well as their personal data. This technology provides an extra layer of security, as the content is encrypted and difficult to manipulate.

For its part, the identity card (Cédula de Ciudadanía) has also evolved. In its current format, it includes a two-dimensional barcode, biometric information of the holder, or fingerprint, which makes it difficult to compromise. This citizenship card is the main identity document and has standardized dimensions of 54.75mm wide by 86.35mm high.

This format aligns with the standards of the International Civil Aviation Organization (ICAO). Among the security measures, it has holograms, microtexts, and a barcode that tries to make forgeries difficult.

Didit: Transforming identity verification and KYC and AML compliance in Colombia

Identity verification in Colombia, along with KYC and AML compliance processes, are complicated and can become a hindrance for many companies wishing to operate in this territory, both local and international. For them, Didit aims to become the ideal partner.

How do we plan to do it? Thanks to a free, unlimited, and forever identity verification service that allows companies to comply with KYC regulations in Colombia and lay the foundations for the prevention of money laundering. In this article, we explain how we can offer this free KYC service while other providers charge you between 1 and 3 dollars for each verification.

Our technology is based on three strategic pillars to solve the specific needs of the Colombian market:

- Document verification: We use artificial intelligence algorithms capable of validating more than 3,000 types of documents from more than 220 countries and territories. Our system detects inconsistencies and extracts information with unprecedented precision, adapting to the complex documentary reality of Colombia.

- Facial recognition: We implement customized AI models that go beyond simple comparison. Our passive liveness test and advanced detection ensure that who is identifying themselves is really who they claim to be, overcoming the documentary fraud challenges characteristic of the Colombian market.

- AML Screening (optional): We perform real-time checks against more than 250 global datasets, covering more than a million entities on watchlists. This process allows companies to comply with the requirements of Law 1121/2006 and UIAF resolutions.

What official documentation does Didit verify in Colombia?

Didit is capable of solving the problems of traditional identity verification systems in Colombia. Our free KYC solution can work with different local documentation: we're talking about identity documents, passports, driver's licenses, and residence permits.

This way, you can verify the identity of your Colombian users without major complications, overcoming the challenges presented by the non-standardized documentation of the South American country.

In short, for the Colombian market, this means:

- Full compliance with the Statutory Law on Personal Data Protection (Law 1581)

- Reduction of operational costs by up to 90%

- KYC processes completed in less than 30 seconds

Do you want to transform the challenges of identity verification in Colombia into a competitive advantage?

Identity Verification, KYC and AML Compliance in Colombia