Key takeaways

Chile leads the digital transformation in Latin America with 348 active fintech startups in 2024, where KYC and AML processes are consolidated as strategic elements to ensure the security of digital transactions.

Identity verification in Chile has become a complex technological challenge, where facial biometrics, artificial intelligence and real-time validation emerge as solutions against financial fraud.

The Chilean regulatory framework, led by the UAF, establishes rigorous compliance standards that require companies to implement increasingly sophisticated and secure document verification systems.

Didit revolutionizes AML processes in Chile through artificial intelligence algorithms capable of validating more than 3,000 types of documents, reducing operational costs by up to 90% and completing verifications in less than 30 seconds.

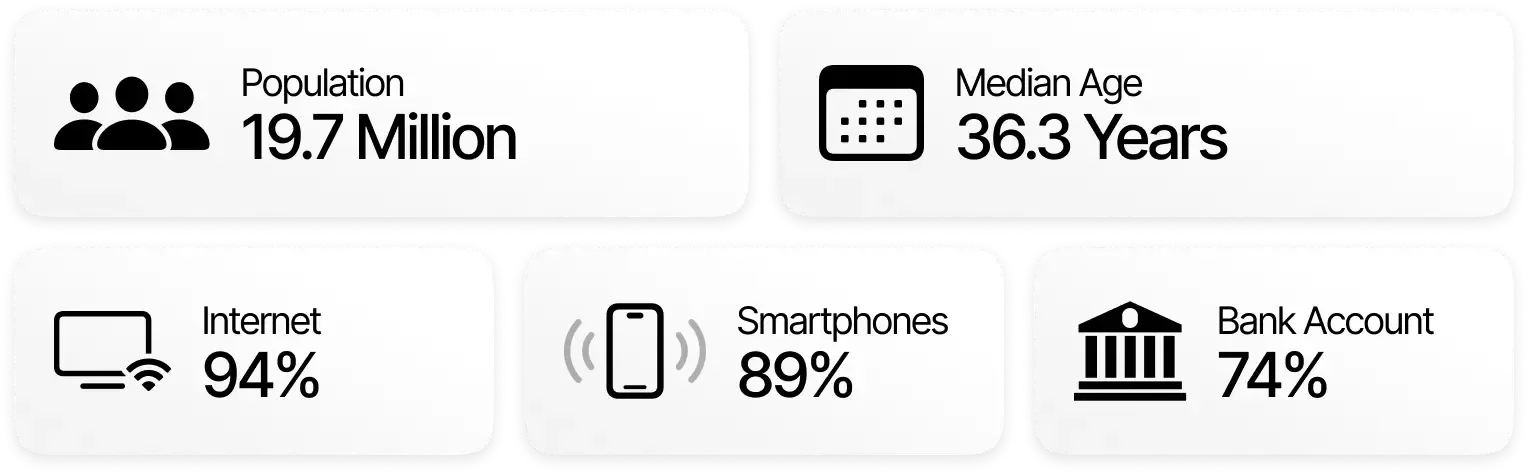

KYC and AML processes in Chile have become fundamental strategic elements to ensure the integrity and security of digital transactions. The country emerges as a technological hub in Latin America, with a fintech ecosystem that has reached 348 active startups in 2024, experiencing 16% annual growth, where digital transformation demands increasingly sophisticated and robust identity verification systems.

The evolution of financial services has caused identity verification to go from being a mere bureaucratic procedure to a critical line of defense against fraud and money laundering. Chile, with its solid regulatory framework and commitment to transparency, is at the forefront of these transformations in the region.

The regulatory complexity regarding KYC and AML in Chile requires advanced technological solutions that can quickly adapt to a constantly evolving regulatory environment. Financial institutions, technology companies and startups, among other obligated subjects in the country, face the challenge of implementing systems that not only comply with regulations, but also offer a smooth and secure user experience.

Chile's commitment to international regulatory compliance standards is reflected in its active participation in organizations such as GAFILAT (Financial Action Task Force of Latin America), which demonstrates its proactivity in the fight against financial crime and the implementation of global best practices in identity verification.

The legal framework of KYC and AML in Chile: regulatory requirements

Chile has built a solid regulatory framework to prevent money laundering and ensure the integrity of the financial system. The regulatory evolution reflects the country's commitment to international standards of compliance and transparency.

Law 19,913: The cornerstone of anti-money laundering in Chile

Law 19,913, known as the Chilean Anti-Money Laundering Law, constitutes the core of AML regulation in the country. This regulation establishes critical obligations for financial institutions, requiring the reporting of transactions exceeding 10,000 USD, the reporting of suspicious operations to the Financial Analysis Unit (UAF) and the implementation of due diligence processes.

The UAF, as the central body, has the power to request and analyze suspicious financial information, and can directly refer background information to the courts when indications of financial crimes are detected. Its role is fundamental in maintaining transparency and preventing illicit activities in the Chilean financial system.

Law 20,393: Corporate criminal liability

Enacted in 2009, this law establishes a fundamental milestone by determining the criminal liability of legal entities in crimes of money laundering, terrorist financing and bribery. Its implementation has radically transformed corporate risk management, forcing companies to develop robust prevention models.

Organizations must implement internal control systems that demonstrate effective diligence in preventing financial crimes. The law not only sanctions the commission of crimes, but also promotes a culture of preventive compliance in the Chilean business fabric.

Law 20,818: Improvement of prevention mechanisms

Published in February 2015, this regulation improved the mechanisms to prevent, detect, control, investigate and prosecute the crime of money laundering. It substantially modified Law 19,913, refining investigation processes and facilitating the work of authorities.

The law introduced significant improvements in coordination between agencies, establishing more efficient protocols for information exchange and early identification of suspicious operations.

Fintech regulation: new regulatory horizon

The recent fintech legislation, approved in October 2022, represents a qualitative leap in the regulatory framework. It reduces barriers for technology companies, recognizes crypto assets backed by fiat currency and establishes rigorous supervision of crypto platforms by the Financial Market Commission (CMF).

This regulation reflects the maturity of the Chilean financial ecosystem, which seeks to balance technological innovation with regulatory security. Fintech companies must now comply with more demanding standards of identity verification and risk control.

Identity verification in Chile: a challenge for companies

Identity verification in Chile has become a complex challenge that transcends simple document validation. The Chilean digital ecosystem is experiencing an accelerated transformation where security and efficiency compete for prominence in digital onboarding processes.

Companies face multiple obstacles in implementing robust identity verification systems. The fragmentation of information sources, the diversity of documents and the need for regulatory compliance configure a scenario of high technological complexity.

Financial digitization has multiplied technological risks, forcing Chilean companies to develop verification systems that balance accuracy, speed and user experience. The convergence of facial biometrics, artificial intelligence and real-time validation is presented as the technological response to mitigate fraud and ensure the security of digital transactions.

The Chilean regulatory framework, led by the Financial Analysis Unit (UAF), imposes a dynamic compliance model that transcends simple initial validation. KYC processes in Chile demand continuous monitoring, transforming each digital interaction into an opportunity for validation and control, which turns regulatory compliance into a challenge of constant innovation for companies.

Challenges in document verification in Chile

Document verification in Chile represents a complex ecosystem where standardization and security converge at a critical point. The country has developed an identification system that combines technological precision with unique design elements.

Contrary to what might be expected, Chilean documents do not follow a completely standardized format. Each document incorporates unique design and identification elements, which increases its complexity but also its security.

The diversity of security elements turns document verification in Chile into a highly specialized process, where technology and design merge to guarantee the authenticity of identity.

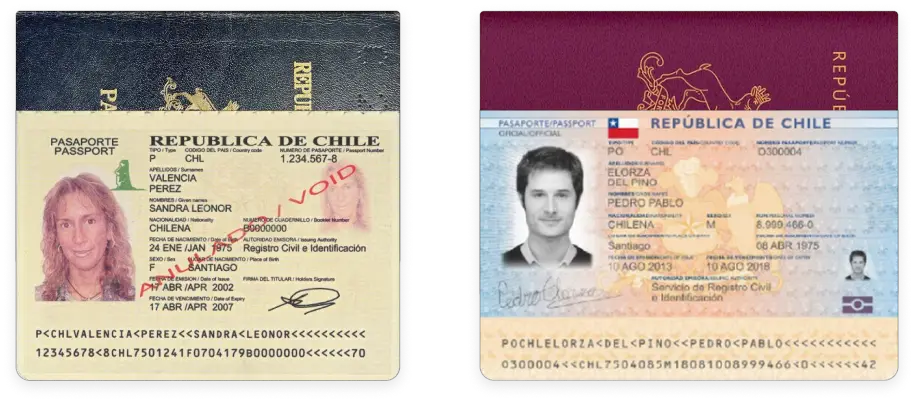

Verification documents: National Identity Card and Passport

Chile has two main identification documents: the national identity card and the passport, each with specific characteristics that reflect the sophistication of the Chilean identification system.

National identity card The Chilean identity card, issued by the Civil Registry and Identification Service, has recently been transformed into a high-security document. The new design, implemented in December 2024, incorporates 32 advanced security measures, with features that make it one of the most secure documents in Latin America.

It integrates a state-of-the-art RFID chip that allows secure storage of biometric data, rapid identity verification and forgery prevention. This chip offers an additional layer of security through encryption of personal information and contactless reading, guaranteeing the integrity of the bearer's data.

Chilean Passport

The Chilean passport represents another fundamental element in identification. Redesigned in 2024, it has 70 security measures and a design that integrates technological and cultural elements.

Its RFID chip complies with the highest international ICAO standards, storing biographical data, biometric information of the holder and an electronic digital signature. This technology allows for rapid and secure international identity verification, positioning the Chilean passport as a cutting-edge document in terms of document security.

Didit: Transforming identity verification and KYC and AML compliance in Chile

Didit is revolutionizing identity verification and KYC compliance processes in Chile, thanks to a free, unlimited and forever KYC service. Our platform integrates advanced technology with a deep understanding of the local regulatory ecosystem.

AML processes in Chile require flexible and adaptive solutions, and it is precisely at this point where Didit positions itself as a strategic ally for companies seeking efficient regulatory compliance.

Document verification

We use artificial intelligence algorithms capable of validating more than 3,000 types of documents from more than 220 countries and territories. Our system detects inconsistencies and extracts information with unprecedented accuracy, adapting to the complex documentary reality of Chile.

The machine learning models are specifically trained to recognize the particularities of Chilean documents, such as the national identity card and passport, ensuring fast and secure verification.

Facial recognition

We implement customized AI models that go beyond simple facial comparison. Our passive liveness test and advanced detection ensure that the person being identified is really who they claim to be, overcoming the challenges of document fraud characteristic of the Chilean market.

Didit's biometric technology incorporates movement analysis, behavior patterns and impersonation detection, offering an additional layer of security in verification processes.

AML Screening (Optional)

With our optional AML Screening service, we perform real-time checks against more than 250 global datasets, covering more than a million entities on watchlists. This process allows companies to comply with the requirements established by the Financial Analysis Unit (UAF) and other local regulations.

Our solution not only detects potential risks, but also provides a continuous monitoring system that dynamically adapts to regulatory changes in Chile.

What official documentation does Didit verify in Chile?

Main documents:

- National identity card

- Chilean passport

In short, for the Chilean market, Didit means:

- Full compliance with the regulations of the Financial Analysis Unit (UAF)

- Reduction of operational costs by up to 90%

- KYC processes completed in less than 30 seconds

Are you ready to revolutionize identity verification in Chile? Click on the banner below and start verifying identities for free.