Key Takeaways

Guatemala faces significant challenges in identity verification, with approximately 15% of its population lacking complete official documentation, representing a potential risk of $500 million annually in illicit activities related to drug trafficking.

Guatemala's legal framework for KYC and AML, comprised of Decrees 67-2001 and 58-2005, establishes control mechanisms to prevent money laundering, with penalties ranging from 10 to 30 years in prison for financing terrorism.

Guatemala's official documents, such as the Personal Identification Document (DPI), passport, and driver's license, incorporate advanced security technologies, including smart chips, biometric information, and anti-counterfeiting measures.

Identity verification solutions like Didit can reduce compliance operational costs by up to 90%, completing verification processes in less than 30 seconds and meeting local and international regulatory standards.

KYC and AML processes in Guatemala are fundamental pillars for the integrity and transparency of the national economic system. The country is immersed in a digital transformation that demands innovative solutions for identity verification and regulatory compliance.

Guatemala, with its complex socio-economic reality, has developed mechanisms to prevent money laundering and ensure the security of financial transactions. However, the challenges are significant: it's estimated that around 2% of the country's GDP, equivalent to about $500 million annually, comes from illicit activities related to drug trafficking. This reality underscores the critical importance of strengthening identity verification and anti-money laundering processes in the country.

Financial institutions, among other obligated parties, technology companies, and regulatory bodies work in a coordinated manner to implement strategies that protect the economy from financial risks. The evolution of Know Your Customer (KYC) and Anti-Money Laundering (AML) processes in Guatemala reflects a growing commitment to international standards of compliance and transparency. This effort materializes in initiatives like the bill proposed in November 2020 to modernize and unify existing regulations, aligning them with the recommendations of the Financial Action Task Force (FATF).

This context demands specialized solutions that understand the complexity of the Guatemalan financial ecosystem, combining cutting-edge technology with a deep understanding of the local regulatory framework. Automation of KYC controls and AML not only enhances operational efficiency and customer experience but is also crucial for mitigating sanction risks, which globally reached nearly $6.6 billion in 2023 due to deficiencies in these processes.

The Legal Framework of KYC and AML in Guatemala: Regulatory Requirements

Guatemala's regulatory framework is designed to combat money laundering and terrorist financing. A historical turning point was the work of the International Commission Against Impunity in Guatemala (CICIG), which between 2007 and 2019 dismantled multiple criminal networks and exposed the deep need to modernize financial prevention systems.

Decree 67-2001: Law Against Money Laundering in Guatemala or Other Assets

Decree 67-2001 in Guatemala defines what constitutes the crime of money laundering. The legislation establishes a control system that involves multiple entities subject to regulation, such as traditional banks, cooperatives, brokerage firms, insurance companies, money transmitters, and real estate agents.

The main objective is to create a transparent financial ecosystem where each actor has specific responsibilities in detecting and preventing irregular activities. The law mandates the implementation of due diligence processes, maintaining detailed records, and reporting suspicious transactions.

Decree 58-2005: Law to Prevent and Repress the Financing of Terrorism

Decree 58-2005 marks a turning point in Guatemala's financial security strategy. It defines the financing of terrorism as a crime against humanity, with penalties ranging from 10 to 30 years in prison.

The regulation introduces sophisticated mechanisms to identify and prevent the financing of terrorist activities, establishing rigorous procedures for investigation and reporting.

Current Regulatory Challenges in Guatemala

In November 2020, Guatemala initiated a legislative reform process with ambitious goals: to modernize its regulations, align them with international standards of the Financial Action Task Force (FATF), and expand regulatory coverage.

The reform proposals specifically seek:

- To include digital wallet services

- To regulate operations with cryptocurrencies

- To broaden definitions of money laundering

- To strengthen mechanisms for financial investigation

Identity Verification in Guatemala: A Challenge for Businesses

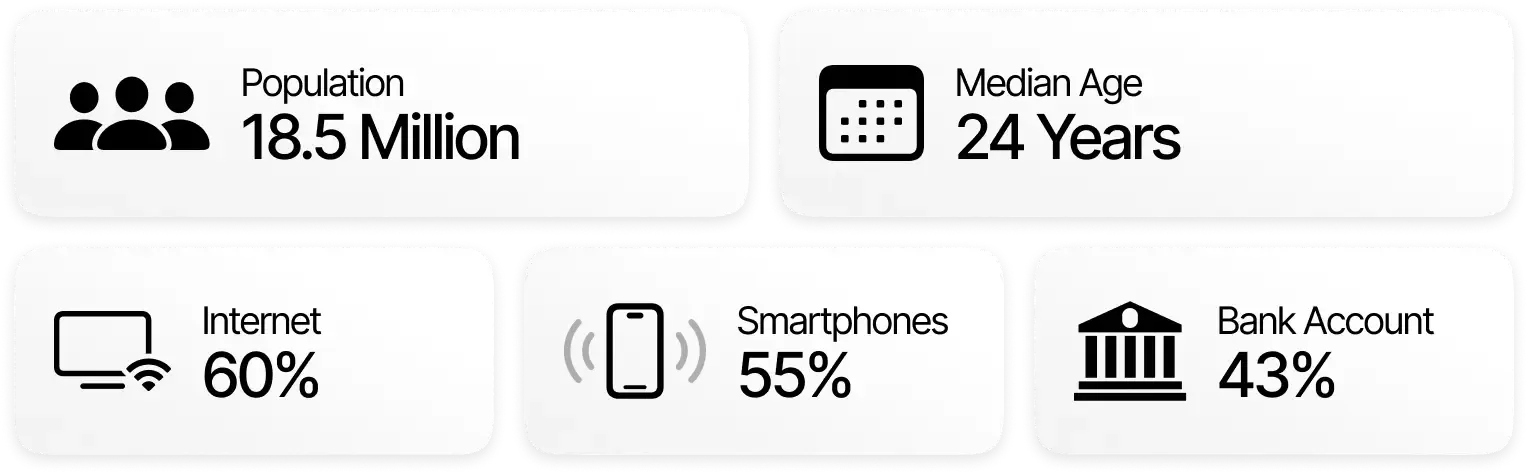

Identity verification in Guatemala represents a complex ecosystem that reflects the structural challenges of the national identification system. The country has a National Registry of Persons (RENAP) that, despite its efforts, maintains significant technological and coverage limitations.

According to official data, approximately 15% of Guatemala's population lacks complete official documentation, which creates a significant gap in digital identification processes. This reality directly impacts businesses' ability to implement robust identity verification systems.

Main Obstacles in Identity Verification

Thus, businesses requiring identity verification for Guatemalans may encounter several challenges. The main ones include:

- Document Complexity: Guatemala presents a diversity of official documents that make standardized verification difficult. The national identification document, passports, and driver's licenses exhibit regional and temporal variations, complicating authentication processes.

- Technological Limitations: Traditional verification systems fall short against sophisticated fraud techniques. The lack of updated technological infrastructure generates vulnerabilities in identification processes.

- Institutional Fragmentation: The absence of an integrated system among different government institutions hinders cross-referencing of information, creating blind spots in identity authentication.

What are the consequences of these deficiencies in identity verification processes? An increase in financial fraud risks, higher compliance costs, limitations to digital financial inclusion, and a reduction in efficiency in digital onboarding processes.

The Challenges in Document Verification in Guatemala

Document verification in Guatemala represents a complex ecosystem with multiple technological and regulatory particularities. The country has developed documents with sophisticated security mechanisms, but it still faces significant challenges in its identification process.

Personal Identification Document (DPI)

The Personal Identification Document (DPI) constitutes the central element of verification in Guatemala, with unique characteristics that make it an advanced identification tool.

Made of polycarbonate with state-of-the-art technology not commercially accessible, the DPI integrates a 13-digit Unique Identification Code (CUI) that allows precise citizen traceability. Its security measures include rainbow printing, numismatic background, variable optical ink, ghost image, and personalized texture.

The embedded smart chip allows storage of biometric information and personal data, transforming the document into one that goes beyond traditional identification.

Guatemalan Passport

The Guatemalan passport features security elements that position it as one of the most sophisticated documents in Central America. The integration of colored fibers, watermark on all pages, and a PDF417 format with biometric information ensures its authenticity.

The biometric photograph, with specific dimensions of 2.6 x 3.2 cm, allows for precise identification of the bearer, significantly reducing the chances of identity theft.

Driver's License

Obtaining a driver's license in Guatemala involves a rigorous process that goes beyond simple document issuance. The process requires a mandatory theoretical-practical exam, an ophthalmological evaluation, a certified driving course, and the submission of complete official documentation.

Didit: Transforming Identity Verification and KYC and AML Compliance in Guatemala

Didit is revolutionizing identity verification and compliance processes in Guatemala, offering a free, unlimited, and forever KYC service adapted to local and international regulations.

We understand the unique challenges of the Guatemalan market: document diversity, technological limitations, and the complexity of identification systems. Our platform helps businesses comply with Guatemala's regulations and aids in improving compliance-related operational costs.

Document Verification

Our artificial intelligence algorithms are designed to validate documents with meticulous precision. Capable of processing over 3,000 document types from 220 countries and territories, we specialize in the Guatemalan document reality.

We use models specifically trained to recognize the particularities of the Guatemalan Personal Identification Document (DPI), passport, and driver's license. Each document is analyzed with algorithms that detect potential inconsistencies, securely extract information, and take the first step toward quick and secure identity verification.

Facial Recognition

We implement personalized AI models that go beyond simple facial comparison. Our passive liveness test and advanced detection ensure that the person identifying themselves is indeed who they claim to be, overcoming the challenges of document fraud characteristic of the Guatemalan market.

Didit's biometric technology can effortlessly combat common frauds such as deepfakes, masks, or pre-recorded videos.

AML Screening (Optional)

To complement our free KYC tool, we offer an optional AML Screening service so businesses can fulfill their anti-money laundering obligations without excessive expenses.

We perform real-time verifications against over 250 global data sets, covering more than one million entities on watchlists. Our system allows businesses to comply with Guatemala's KYC and AML regulations, including Decrees 67-2001 and 58-2005.

What Official Documentation Does Didit Verify in Guatemala?

Didit's technology enables businesses to comfortably verify the main official documents of Guatemala, such as the Personal Identification Document (DPI), Guatemalan Passport, and driver's license.

Ultimately, for the Guatemalan market, Didit means:

- Full compliance with local regulations

- Reduction of operational costs by up to 90%

- Verification processes completed in less than 30 seconds

Are you ready to revolutionize identity verification in Guatemala? Our solution isn't just a tool; it's a technological transformation tailored to your reality.