FaceTec Alternative (2025): Didit, the most flexible and complete identity verification platform

With over 3.5 billion annual verifications (per the company’s own figures), FaceTec has become a true benchmark in biometric verification. Founded in 2013 in the United States, the company has secured its position thanks to its 3D liveness detection and facial recognition software, used in many high-risk environments. Its proposal aims to replace traditional authentication methods like passwords or manual document checks. But is FaceTec’s approach a fit for every business?

Thanks to its specialization, FaceTec has proven to be a solid partner for user verification. However, its offering shows several gaps that are hard to overcome for companies that need an end-to-end suite to run their due-diligence workflows. In this context, Didit meets real, current market demands with an open, modular, and flexible platform capable of building complete identity verification flows, with features such as ID Verification, Face Match 1:1, Liveness, and AML Screening.

So, if you’re looking for a FaceTec alternative that helps you fight fraud effectively without forcing you to bolt on third-party tools to validate users and perform due diligence, Didit is the solution you need. In this article we explain why Didit has become the fastest-growing identity verification platform in recent months, with 3,000+ companies already trusting us to validate their users.

Note: This comparison is based on online research and user comments across multiple platforms. This content was updated in the third quarter of 2025. If you believe anything is inaccurate or you need a specific correction, please contact us.

What does FaceTec offer?

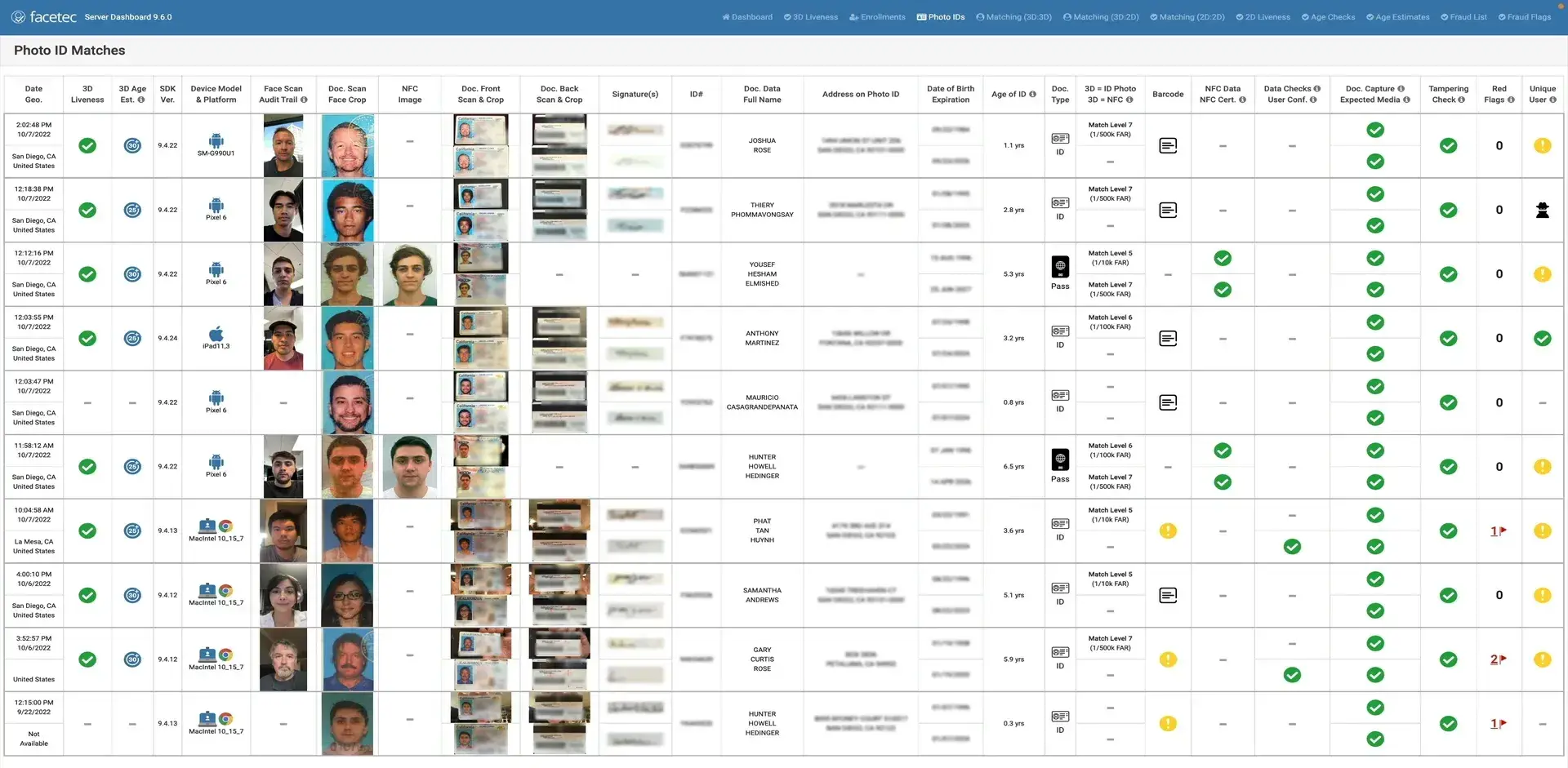

FaceTec is a face-biometric identity verification platform with liveness detection. It also includes document verification and other features such as age estimation or biometric authentication, although its core is liveness. So much so that it acts as a biometrics provider for many recognized platforms, including IDnow, iDenfy, Ondato, Unico, and Yoti, among others.

However, it doesn’t fully address the needs of every company that truly requires a KYC solution:

- Opaque pricing and minimum commitments. FaceTec doesn’t publish official pricing, making cost estimation difficult. Usage is based on licenses with monthly minimum commitments—an adoption barrier for many.

- Mandatory self-hosting. The software must run on the customer’s servers, which demands extra technical resources; it’s not a plug-and-play SaaS.

- Incomplete due diligence. While FaceTec covers document and biometrics, it omits key KYC/AML capabilities like AML Screening, forcing teams to integrate third parties to meet AML/CFT.

- UX friction. In many cases users must repeat steps during document capture and biometric validation; moreover, on some Android devices the experience may not work properly. This can increase drop-offs and reduce conversion.

- Complex interface. In our direct experience, the dashboard is confusing and not very intuitive, which slows down oversight of user verifications.

As a result, while FaceTec provides a precise and secure biometric solution, its model doesn’t fit modern companies that demand simplicity, flexibility, and cost control.

Why is Didit different? A simple, open, flexible, and cost-effective alternative to FaceTec

Didit is the most advanced identity verification platform on the market and offers the only free and unlimited KYC plan. As a FaceTec alternative, it brings:

- Transparent pricing. While FaceTec hides pricing behind sales, Didit publishes prices so teams can forecast spend.

- Self-service start. All you need is a corporate email to get going. In minutes you’ll be verifying users—no sales cycles.

- Flexibility and autonomy. No contracts, minimums, or lock-ins. Didit runs on non-expiring prepaid credits, so you validate at your own pace.

- Integration in minutes. Start in minutes with verification links, and when you need it, use open APIs for maximum flexibility.

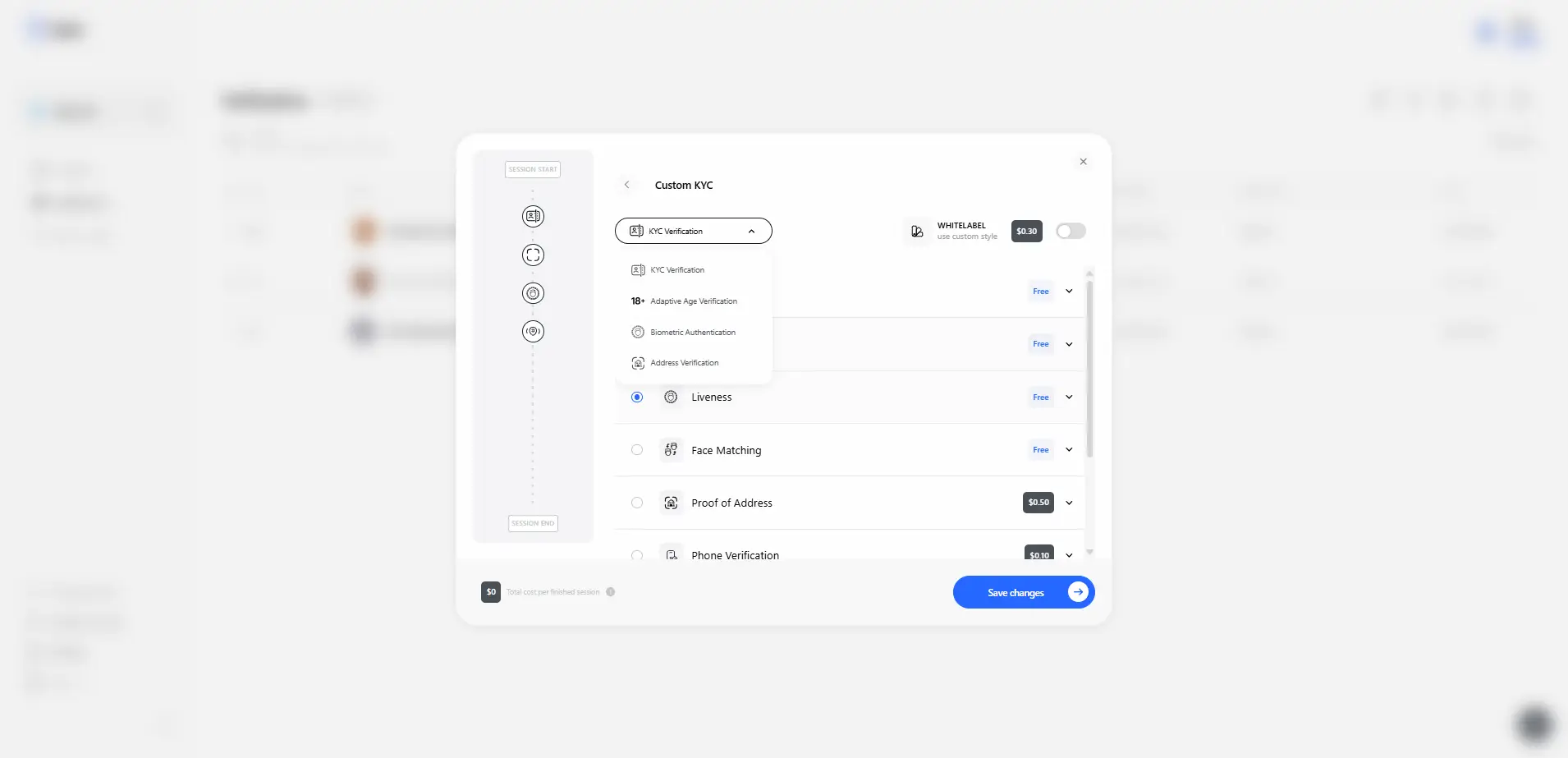

- All-in-one platform. A complete suite: ID Verification, biometrics, AML Screening, Phone Verification, Proof of Address.

- True global coverage. Documents from 220+ countries and territories and AML checks against sanctions, watchlists, and PEPs—no third parties needed to complete your due diligence.

Advanced Biometrics in Didit: Face Match, Face Search, Liveness & Biometric Authentication

If you’re reading this, chances are you're looking for a provider that offers biometric identity verification for your users. And that makes sense. Facial biometrics has become the standard to prevent fraud, avoid impersonation, and ensure that the person on the other side of the screen is who they claim to be.

The difference lies in how each provider does it. While certain companies focus solely on 3D Liveness, at Didit we’ve developed multiple features that adapt to your business needs and risk appetite.

- Face Match 1:1. Compare a live selfie with an identity document photo or a stored reference image in real time.

- Face Search 1:N. Detect duplicates or fraud attempts within your own user base.

- Three Liveness Methods. Tailor validation depending on risk level and UX preferences.

- Biometric Authentication. Re-verify already-identified users without asking for their documents again.

This modular, flexible approach lets each company choose the security level they want to apply depending on the scenario. From fast, frictionless onboarding to validating critical transactions that require maximum security.

Face Match 1:1

- What it is. Face Match 1:1 is a technology that compares a live selfie with the photo from an ID document or a stored portrait.

- Advantages. Delivers high accuracy (99.9%), tolerates changes in lighting, pose, or mild facial expressions. Analyzes up to 68 facial points to ensure genuine matches.

- Use case. During initial onboarding, ensures the user is really who they say they are.

Face Search 1:N

- What it is. Allows you to search for a face among all your already verified users.

- Advantages. Prevents duplicate accounts, detects fraud patterns, and automatically blocks registration attempts from flagged suspicious users.

- Use case. Critical in industries prone to multiple accounts fraud, such as fintech, iGaming or telcos — where fraudsters try the same attack using different identities.

Liveness Detection Methods

Liveness detection is what stops a fraudster from using a photo, a mask, video, or deepfake to impersonate someone. Didit offers three methods, designed to balance security and user experience.

- Passive Liveness. Single image AI‑based analysis that detects anomalies, edges, or reflections. It’s the fastest method and causes no friction.

- Active 3D Flash Liveness. Project different light patterns onto the face to create a depth map. No user interaction required, but stronger protection against photos or pre‑recorded screens.

- Active 3D Flash & Action Liveness. Highest security level: combines dynamic light patterns with a random action (e.g. move the head, blink…). Ensures maximum protection against masks, video, or spoofing attempts.

The passive method is ideal for initial registrations or low‑risk environments, while the active modes shine in financial services or high‑security access points.

In any case, Didit returns a configurable risk score (0‑100) so you can set your threshold according to your business policies.

Biometric Authentication

This feature complements the other modules for recurring users or login sessions, so users don’t have to provide documentation again.

- What it is. A flow that allows biometric re‑verification without re‑scanning documents.

- Advantages. Fast validation in just seconds, reduces friction by avoiding repeated document verification, improves retention of existing users.

- Use case. Particularly relevant when validating high‑value transactions (e.g. over $1,000), ensuring process security and preventing account takeovers. In practice, it’s the most effective way to balance security and UX for recurring users.

Thanks to all these biometric features, Didit lets you adapt your verification flows across different risk scenarios, reduce friction for recurring users, and ensure identity management with stronger control.

Use cases where Didit beats FaceTec

- Projects that need to launch now. FaceTec requires sales, minimums, and your own server. Didit lets you start verifications with a corporate email, using links and open APIs.

- Tight budgets. FaceTec operates with minimums and non-public prices. Didit offers free, unlimited KYC and a no-expiry prepaid model for premium—no hidden fees.

- End-to-end compliance. FaceTec excels at biometrics/liveness but doesn’t offer AML Screening or other key pieces. Didit brings everything into one platform (AML, biometrics, Age Estimation, Proof of Address, etc.).

- Global operations. Didit validates documents from 220+ countries and territories and runs screening against hundreds of sanctions, watch, and PEP lists.

- Organizations focused on UX. FaceTec can force retries more often than desired, driving abandonment. Didit reduces friction with adaptive flows, fast verifications, and full customization based on your risk appetite.

Comparison table: Where does Didit outperform FaceTec?

Why look for a FaceTec alternative in 2025: Didit, the best identity verification platform on the market

FaceTec has cemented itself as a leader in facial biometrics and liveness detection. Its technology is used by major corporations and government projects. However, the reality in 2025 is different: companies demand biometric security, of course, but paired with agile, accessible, and complete solutions that cover the entire identity-verification lifecycle without hidden costs or third-party dependencies. This is precisely where FaceTec falls short.

Didit emerges as the natural alternative for companies that don’t want barriers to entry, rigid contracts, or lengthy integrations. We’re an open, flexible, simple, and affordable platform built to grow with you: in just minutes you can launch robust, automated, and tailored verification flows for your business model.

More and more companies are switching to Didit because:

- Free, unlimited KYC. The only plan on the market that’s completely free and unlimited, with no entry costs.

- Fast, low-friction onboarding. Verify users in minutes with verification links, no servers to set up, and no need to talk to sales.

- Comprehensive compliance coverage. Beyond document verification, biometrics, and liveness, you get AML Screening, Proof of Address, Age Estimation, and Phone Verification in one platform.

- Modular, flexible workflows. Design flows tailored to your business. No contracts or lock-ins.

- Real international scale. Documents from 220+ countries and territories and AML screening against hundreds of global lists.

In 2025, the best FaceTec alternative is called Didit—a platform that blends security with transparency, flexibility, and accessibility for today’s digital businesses.

💬 Have questions or already using FaceTec and considering a migration? Write to hello@didit.me and we’ll help you assess the impact on fraud, conversion, and costs.

FaceTec Alternative (2025): Didit, the most flexible and complete identity verification platform